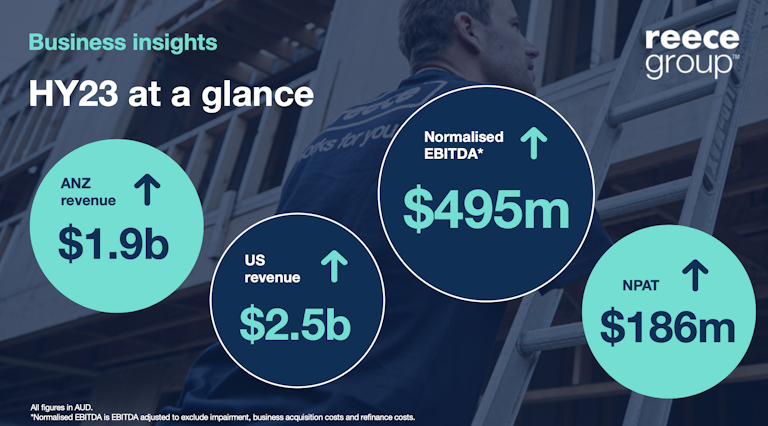

For the first half of FY23, Reece Group has delivered another strong result with revenue up 23% on the prior period to $4.4b. Normalised EBITDA is up 25% to $495m.

Peter Wilson, Group CEO, said: “We have delivered another strong result driven by persistent inflation and supported by the strong ongoing execution by our team”.

In Australia and New Zealand, revenue grew by 11% to $1.9bn (HY22: $1.7b). In the US, revenue was up by 34% to $2.5b (HY22: $1.9b).

The first half of the year saw our global business achieve a number of key milestones on our journey to be our trade’s most valuable partner.

In ANZ, we achieved a Customer Net Promoter Score of +60, a strong indicator that our focus on the fundamentals over the past two years has paid off with our customers. We also expanded our strategic offering in the pools space with the acquisition of Dontek Electronics and International Quadratics. Finally, we welcomed Scott Marshall, currently CEO of Supermarkets and Convenience at Metcash, who will lead the growth of our ANZ business as Reece’s new ANZ CEO.

In the US, we have continued progressing with our multi-pronged strategy to upgrade and improve our existing network and roll out new branches across our business units in refreshed formats. Throughout the half, we continued to focus on developing talent with new training and development courses, building out our product mix and introducing new value-added services, like trialling Saturday trading and rapid delivery.

After four years of hard work, our California stores are now trading under the Reece brand. We have listened to our customers, uplifted standards, and refreshed our proposition to deliver a customised service offering that suits the local market and truly reflects what the 100-year-old Reece brand stands for. This is the first step in simplifying our brand presence from 12 brands to one Reece brand. Over the next few years, more states in the US will roll on to the Reece brand.

Reflecting on the outlook for the remainder of the financial year, Wilson continued: “As expected, we saw a progressive softening in volumes over the first half and we are preparing for this to continue over the remainder of the year. In this context, we will be disciplined on cost while investing through the cycle and maintaining our focus on our 2030 strategy to deliver for our customers, as we always do.

“With our truly long-term perspective and our resilient business model, we can look beyond the cycle to deliver on our vision of being our trade’s most valuable partner.”

For more details on the HY23 results, check out our investor centre.